About MNLU

Maharashtra National Law University Mumbai, established under the Maharashtra National Law University Act 2014 on 20th March 2014, is one of the premier National Law Universities in India. The Act envisaged establishing National Law University in Maharashtra to impart advanced legal education and promote society-oriented research in legal studies for the advancement of the societal life of the people in the country.

About the GSTPAM

The Goods & Services Tax Practitioners’ Association of Maharashtra (formerly known as The Sales Tax Practitioners’ Association of Maharashtra / STPAM) is a State-level body of Sales Tax Practitioners’ established in the year 1951. The Association has its membership spread all over the State of Maharashtra comprising of Tax Practitioners and other professionals such as Chartered Accountants, Cost Accountants, Company Secretaries and Advocates practicing in GST, VAT, Service tax and allied laws. The Association has Regional Centres at district places to cater to the needs of members practicing in various districts of Maharashtra. The STPAM now renamed as GSTPAM is governed by its own constitution and is registered with the Charity Commissioner and also under the Societies Act. The elected President, Officer Bearers and 15 members of the Managing Committee conduct the activities of the Association.

About the center

The Centre for Advanced Training in Taxation laws is established at Maharashtra National Law University, Mumbai with the objective to advance Studies and Research in the area of Taxation. Dr. CS Shama Shah Ph.D, CS-ICSI, LL.B, MBA, PGDFM, FDP – IIM Indore, CMA, LLM, is the Honorary Director of the Centre. The Centre has the vision to foster and promote a thorough understanding of the Indian Tax System, tax policies and laws and their implication for domestic and International Business Practices. Taxes in India are levied by the State and Central Government. While tax law might sound to be something very generic, it is indeed one of those aspects of the Indian Legal Structure that tend to affect every Indian citizen on a daily basis. Although many believe that Tax law demands great quantitative skills, it rather wants the student’s focus on ethics, passions for the subject and incomparable intellectual capacity to keep up with the tax reforms.

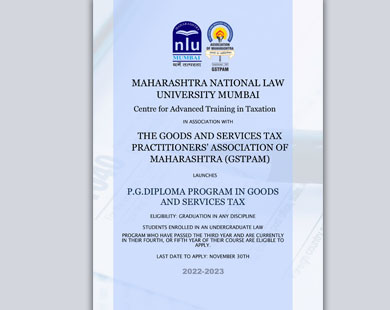

About the course

In the process of enhancing its academic horizon, Maharashtra national law university Mumbai under its Centre for Advanced Training in Taxation Laws is coming up with new course under the active guidance of the Vice Chancellor Prof. Dr. Dilip Ukey. The university is introducing P. G. Diploma Program from the year 2021 as a professional booster to practicing advocates and other professionals. The course is designed to provide handling of litigation in indirect taxes. How to prepare and represent before the departmental authorities in various proceedings like adjudication, appeals inspection and search.

About the teachers

Adv Ratan SamalCA Deepak Thakkar

Adv C.B. Thakar and Rahul ThakarAdv Path Badheka

Adv Dinesh M TambdeGSTP Dilip Parekh

CA Sujata RangnekarAdv. Shashank Dhond

Adv Deepak BapatAdv. Sunil Khushlani & Sachin Gandhi

CA Ashit ShahCA Aditya Seema Pradeep

CA Umang TalathiCA Prasad Kshirsagar

CA Janak VaghaniCA Kunal Salvi

CA Dharmen Shah

Syllabus of the course

Dates: Semester 1 – 21 January, 2023 to 24 June, 2023 (Saturdays and Sundays only)

Timings: 09:00 am to 11:00 am

Registration Link:

Kindly fill the form on the following Link: https://mnlumumbai.edu.in/pgdgst.php, attach the fee receipt and mail on pgdiplomagst@mnlumumbai.edu.in

Last date extended: 31st January,2023

Link for further details: https://mnlumumbai.edu.in/pgdgst.php

Contact Person: Mahvish Kazmi (Ph.no. : 8291452478)

To Know More, refer Brochure_DiplomaGST2022 and DiplomaGST2022_flyer

2024-2025 batch ?