Introduction

The layering restriction on Indian companies under the Companies (Restriction on Number of Layers) Rules, 2017 (the Rules)1 was yet another clampdown by the Indian Government against illicit siphoning of fund by corporate entities. Despite certain loopholes, the Rules attempt to bring more comprehensiveness and clarity on the law prohibiting illegal diversion of fund, especially when enforced along with its predecessor statutes, such as Section 1862 of the Companies Act, 2013, the Prevention of Money-Laundering Act, 20023, Section 4204 of the Penal Code, 1860 and the Benami Transactions (Prohibition) Amendment Act, 20165.

There are some “hits” and some “misses” in the extant layering restriction on companies, which this article tries to identify. The attempt here is to bring forth certain interpretations of the law relating to the layering of companies by understanding it against the backdrop of various related committee reports that had set the ball rolling for these Rules, and discuss a few selected ambiguities in the law, wherein much-needed clarity could help the Government to keep a better check on the malpractices it proposes to curb vide these Rules.

Historical background

The Government of India on 27-4-2001, constituted the Joint Parliamentary Committee (JPC) on Stock Market Scam and Matters Relating There to under the chairmanship of Mr Prakash Mani Tripathi to submit the Report on Stock Market Scam (JPC Report)6. The JPC Report inter alia considered the role of promoters and corporate entities in the stock market scams, while doing so, JPC recommended that the measures suggested by the Securities Exchange Board of India (SEBI), for curbing the ways of siphoning of fund by companies and preventing the proliferation of shell companies, which majorly included the following:

(a) to prevent the incorporation of shell companies and using of fictitious details for the incorporation, immediate changes and revision in the regulatory framework relating to the company incorporation it was suggested to include the adequate mechanism for the verification of details submitted at the time of incorporation of a company;

(b) yearly disclosure regarding the floating or registering of subsidiaries/associate companies;

(c) quarterly disclosure of change in investments by the subsidiaries/associate companies;

(d) restriction on floating of investment companies by the parent company; and

(e) verification of antecedents of the person behind the investment companies.

After almost two years of the submission of JPC Report, Ministry of Corporate Affairs on 2-12-2004, constituted the Expert Committee on Company Law (Expert Committee)7 under the chairmanship of Mr Jamshed J. Irani to suggest the measures under the then existing company law which inter alia included measures to be taken at the time of and in relation to registration of companies. Surprisingly, the Expert Committee while deviating from the suggestion given by the JPC in JPC Report, which mostly reiterated the SEBI’s measures, recommended that there may not be a limit on companies to have subsidiaries or on such subsidiaries having further subsidiaries (i.e. step-down subsidiary), however, at the same time, adequate reporting requirement may be included in the current regime of the company law for fair and timely disclosure of truthfulness of the transaction. Thus, the Expert Committee resorted to disclosure measures rather than a blanket restriction on layers of the subsidiaries that company may have under the company law.

After various recommendations, including that of JPC and the Expert Committee, the Central Government vide its Notification dated 30-8-2013, notified the Companies Act, 20138 wherein the proviso to the definition of the subsidiary company under Section 2(87)9 was introduced which reads as “Provided that such class or classes of holding companies as may be prescribed shall not have layers of subsidiaries beyond such numbers as may be prescribed.” Additionally, it is to be noted that in Section 186(1) of the Companies Act, 2013, layering restriction through the investment company was also introduced and same was notified with effect from 1-4-2014.Pertinently, though the proviso to Section 2(87) restricting the number of subsidiaries was introduced in the Companies Act, 2013, however, the same was kept in abeyance at the discretion of the Central Government.

The Ministry of Corporate Affairs (MCA) vide its order dated 4-6-2015, constituted the Companies Law Committee (CLC) under the chairmanship of Mr Tapan Ray, then Secretary of Ministry of Corporate Affairs, to look into provisions of the Companies Act, 2013, restricting the layers of subsidiaries and any other related matters thereto. CLC in its report dated 1-2-2016 (CLC Report)10, agreed with the stand taken by the Expert Committee (i.e. not favouring the layering restrictions) and recommended the omission of both the layering provisions under the proviso to Section 2(87) (which was yet to be notified on the date of CLC Report) and the restriction imposed under Section 186(1) of the Companies Act, 2013, with respect to layers of the investment companies. CLC members were of the opinion that these restrictions might adversely impact legitimate business structuring and imposing such blanket restriction on the layers of subsidiaries will put the Indian companies in a disadvantageous position in comparison to their international counterparts (as earlier recommended by the Expert Committee in its report). Further, to tackle the situation of illegitimate fund transfer and to support its recommendation of omitting the layering requirements under the Companies Act, 2013, CLC recommended, in line with the recommendation of Financial Action Task Force (FATF) and aligning the provisions of the Companies Act, 2013 with the Prevention of Money-Laundering Act, 2002, to include definition of beneficial interest, adequate disclosure requirement in relation to beneficial interest and maintaining the register of beneficial interest.

Despite the constant efforts of various committee as noted above, Ministry of Corporate Affairs, contrary to the recommendation made by various committees, vide its Notification dated 20-9-201711 notified the proviso to Section 2(87) of the Companies Act, 2013; additionally, vide its notification of the even date also notified the Companies (Restriction on Number of Layers) Rules, 2017, thereby imposing blanket restriction on power of company to have subsidiaries and such subsidiaries having further subsidiaries.

Governing law

The extant provisions of law governing the “layering rule”, as it is most commonly referred to as, are under Sections 2(87) and 186 of the Companies Act, 2013 (Act), read with, the Rules. The said provisions are a significant improvisation on the erstwhile Section 372-A of the Companies Act, 195612 that dealt with limited restriction on investment by companies, mostly pertaining to the restriction on quantum of such investment. The restriction under “layering rule” has been conceptually conceived under the new company law regime.

Under Section 186(1) of the Act, a company is restricted from making investments through more than two layers of investment companies, with the exception that a company is permitted to acquire13 any other company incorporated outside India if such other company has investment subsidiaries beyond two layers as per the laws of such country. Rule 2(1) of the Companies (Restriction on Number of Layers) Rules, 2017 further expands the scope of the restriction on laying and states that a company is restricted from making investments through more than two layers of subsidiaries, with the exceptions that — (a) a company is permitted to acquire any other company incorporated outside India if such other company has subsidiaries beyond two layers as per the laws of such country; and (b) one layer which consists of one or more wholly-owned subsidiary or subsidiaries of the company shall not be taken into account while computing the layers. Simply put, although Section 186(1) retrains a company from having downstream investment involving more than two “investment subsidiaries”, regardless of the total number of corporate layers, whereas Rule 2 imposes a blanket restriction on companies from having more than two corporate layers. It should be noted that the layering restriction under the Act and Rules is only with respect to vertical layering, as any number of horizontal subsidiaries will constitute a single layer.

The two significant terms used in both the aforementioned provisions are “investment company” and “subsidiary/ies”. The term “investment company” is defined under the Explanation to Section 186 of the Act as “a company whose principal business is the acquisition of shares, debentures or other securities and a company will be deemed to be principally engaged in the business of acquisition of shares, debentures or other securities, if its assets in the form of investment in shares, debentures or other securities constitute not less than fifty per cent of its total assets, or if its income derived from investment business constitutes not less than fifty per cent as a proportion of its gross income”. Further, Section 2(87) of the Act provides for an exhaustive definition of a “subsidiary” or “subsidiary company”, to mean company in which the holding company has the following powers — (a) control over the Board of Directors; and/or (b) control of more than 50% of the total voting rights, either on its own or together with one or more of its subsidiary companies; the terms “subsidiary” or “subsidiary company” also includes the step-down subsidiaries of a holding company.

It is pertinent to note that the Companies (Restriction on Number of Layers) Rules, 2017 had come into effect prospectively from 20-9-2017, and thereby, expanded the scope of the existing layering restriction under Section 186(1) of the Act to include all subsidiaries and not just “investment subsidiaries”. The intention of the legislature was to broaden the gamut of the layering restriction through the new Rules, without contradicting the Act as is stipulated under sub-rule (3) of Rule 2 of the Rules, which states “The provisions of this rule shall not be in derogation of the proviso to sub-section (1) of Section 186 of the Act.” Further, by coming into effect of the Rules, the Government prescribed the permitted number of layers referred in first proviso to Section 2(87) which states that “such class or classes of holding companies as may be prescribed shall not have layers of subsidiaries beyond such numbers as may be prescribed.”

A bird’s eye view of the fundamental distinctions between Sections 186(1) & 2(87) and the Rules is tabulated below—

|

Section 2(87) of the Act |

Section 186 of the Act |

Rule 2 of the Rules |

|

Restriction |

||

|

Holding companies cannot exceed the prescribed number of layers of subsidiaries, wherein the holding-subsidiary relationship is on account of exercise of “control”. |

No company can invest through more than 2 layers of the investment companies. Literal interpretation of the said provision would suggest that — (a) the relationship between any two layers of companies is based on investment; and (b) the investee company need not necessarily be a “subsidiary” (i.e. “control” is not required). |

No company can have more than 2 layers of subsidiaries. As per the said Rules, the relationship between any two layers of companies is based on “control”, as the layer herein refers to a layer of subsidiary or subsidiaries. |

|

What constitutes a layer? |

||

|

Any body corporate. |

An investment company. |

A subsidiary. |

A general exemption for applicability of the restrictions under the layering rule under Rule 2 of the Rules and to the following classes of companies—

(a) a banking company as defined in clause (c) of Section 514 of the Banking Regulation Act, 1949 (10 of 1949);

(b) a non-banking financial company as defined in clause (f) of Section 45(I)15 of the Reserve Bank of India Act, 1934 (2 of 1934) which is registered with the Reserve Bank of India and considered as systematically important non-banking financial company by Reserve Bank of India;

(c) an insurance company being a company which carries on the business of insurance in accordance with provisions of the Insurance Act, 1938 (4 of 1938)16 and the Insurance Regulatory Development Authority Act, 1999 (41 of 1999)17; and

(d) a government company referred to in clause (45) of Section 218 of the Act.

[Similar exemption against applicability of Section 186 layering restriction has been provided to the aforementioned classes of companies under Section 186(11) of the Act.]

The penal provision for contravention of the Rules, as per Rule 2(5) of the Rules, is punishable with fine which may extend to ten thousand rupees for the company and every officer of the company who is in default, and where the contravention is a continuing one, with a further fine which may extend to one thousand rupees for every day after the first during which such contravention continues.

Selected discussion points

1. Exemptions to WOS under the Rules

The second proviso to Rule 2 of the Rules states “Provided further that for computing the number of layers under this rule, one layer which consists of one or more wholly owned subsidiary or subsidiaries shall not be taken into account.” The proviso does not specifically mention the layer of wholly owned subsidiary (WOS) which shall be exempted i.e. whether the WOS referred to herein is that of the ultimate holding company or any other company in the corporate layers.

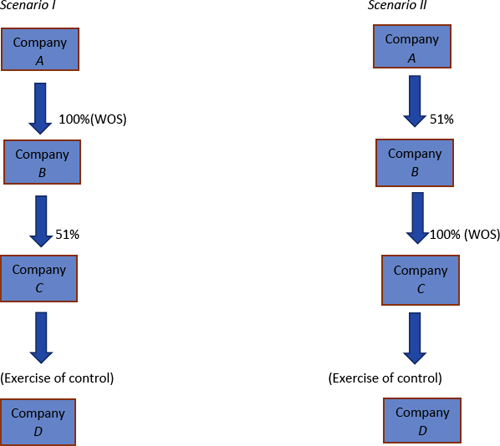

We may analyse this proviso using the following illustration:

In Scenario I:

-

Company B, being a WOS of reporting company (Company A), is the first layer; however, same is exempted under second proviso to Rule 2 of the Rules.

-

Therefore, considering that Company B is exempted, Company C and Company D are permitted layers.

In Scenario II:

-

Company B being a subsidiary of Company A, will constitute the first layer.

-

Company C is WOS of Company B. However, the Company C cannot avail the exemption as it is not a WOS of the Company A. The intention of the legislature is to provide exemption to one layer of direct WOS of the reporting company (Company A).

From scenarios explained above, it can be deduced that the exemption in relation to WOS can only be availed when such WOS is in the first layer of the corporate layers. For instance, if we were to consider exempting Company C in Scenario II while computing layers for Company A, it would defeat the purpose of layering restriction under the Rules as Company C is nothing but a step-down subsidiary of Company A, wherein Company A indirectly holds 51% of Company C.

In general, the golden rule of interpretation is that provisions of a statute have to be given its literal and natural meaning. However, the mischief rule of interpretation states that if the literal meaning of the provision defeats the very objective of the law, then the literal interpretation will not be applicable. The authors are of the view that a literal interpretation of the second proviso to Rule 2 will overlook the objective behind the Rule, which is to prevent the creation of conduit companies for diversion of funds/money laundering, and thus, excluding any layer consisting of wholly owned subsidiary or subsidiaries would be contrary to this very objective.

2. Exemption for offshore subsidiaries

The first proviso to Section 186(1) states, “Provided that the provisions of this sub-section shall not affect — (i) a company from acquiring any other company incorporated in a country outside India if such other company has investment subsidiaries beyond two layers as per the laws of such country.…” Further, the first proviso to Rule 2 of the Rules states, “Provided that the provisions of this sub-rule shall not affect a company from acquiring a company incorporated outside India with subsidiaries beyond two layers as per the laws of such country….” We note that the layering restriction limit the number of permissible layers for an Indian company to 2 layers, and the said restriction does not extend to companies incorporated under other jurisdictions.

Quite discernibly, the ultimate intent of the legislature behind the said exemption appears to allow the offshore corporate layers of a foreign acquiree/investee company of an India acquirer/investor be governed by their respective jurisdictions, as these offshore step-down subsidiaries are beyond the territorial jurisdiction of India. For example, if Company X acquires Company Y situated in Singapore, the number of permissible layers of Company Y will be decided as per the relevant laws of Singapore, whereas Company Y itself will be counted as a layer of Company X under the Act and Rules.

While the basic objective behind the said exemption is understandable, one may appreciate that the said carve-out is not comprehensive enough to cover a large number of permutations of corporate layering structures involving foreign subsidiaries. For instance, a literal interpretation of the first provisos to Section 186(1) and Rule 2, respectively, state the acquisition of another company having more than 2 layers is not violating the layering restrictions is the latter company is protected by the laws of its jurisdiction i.e. “subsidiaries beyond two layers as per the laws of such country” (first proviso to Rule 2). However, in a scenario wherein such acquiree company has exceeded the number of permissible layers as per the laws of its jurisdiction, it is left open to interpretation as to whether the exceeding layers would be counted as “layers” as per the Act and Rules, and accordingly, come within the purview of the layering restrictions therein.

We may use the below illustration for better understanding:

In the above illustration:

-

We assume that the number of permissible layers in State X is 2 layers.

-

In the event Company E acquires Company F (i.e. constituting the third layer), Company C will be in non-compliance under the laws of State X. Although the non-compliance by Company C is governed by laws of State X, it is unclear as to what repercussion that the said non-compliance may have on Company A.

In the view of the authors, as long as a literal interpretation of the provision is not in derogation with the objective envisaged therein, the same shall be applied. Therefore, the authors are of the opinion such exceeded layer (i.e. Company F in the above illustration) will be counted as a layer of Company A as it is not as per the laws of its relevant jurisdiction, and accordingly, Company A will be in violation of the Rules upon such acquisition of Company F. It should be noted that the opinion stated above is in the absence of any clarification provided by the Ministry of Corporate Affairs with respect to the said issue.

Conclusion

The Act and Rules imposing restriction on layering of companies is not devoid of flaws, which are mainly attributable to oversight in drafting the language of the relevant provisions. Nevertheless, the layering restrictions have forced companies to relook at their existing corporate structures at the time of enforcement of the Rules (on account of the grandfathering effect of the Rules) and rethink their future restructurings based on the said restrictions. In the authors’ opinion, the companies most significantly affected by the Rules would be infrastructure companies whose business operation mainly bank upon creation of new subsidiary special purpose vehicles (SPVs) for each of their project to avail separate funding for the respective projects. Although these infrastructure companies are free to establish as many horizontal SPVs based on the number of projects undertaken, it is undeniable that coming into effect of these Rules have curtailed their flexibility to structure their subsidiaries even if it is for genuine business purposes.

Whilst it is near to impossible to account for all possible permutations of layering by companies in the layering restriction, we believe that the lacunas in the prevailing law can be effectively addressed through insertion of some clarificatory language in the relevant provisions. One may expect a thorough re-evaluation of the existing provisions in the coming future based on the evolving nature of business operation by companies, however, at present; it may suffice to plug-in the lapses by way of an explanation and/or clarification by the Ministry of Corporate Affairs.

† Corporate/M&A Lawyers. Author can be reached at pprerna.2207@gmail.com.

†† Corporate/M&A Lawyer. Author can be reached at Dediwal@gmail.com.

1. Companies (Restriction on Number of Layers) Rules, 2017.

2. Companies Act, 2013, S. 186.

3. Prevention of Money-Laundering Act, 2002.

4. Penal Code, 1860, S. 420.

5. Benami Transactions (Prohibition) Amendment Act, 2016.

6. Report of the Joint Committee on Stock Market Scam and Matters Relating Thereto.

7. Report of the Expert Committee on Company Law. [pending uploading]

9. Companies Act, 2013, S. 2(87).

10. Report of the Companies Law Committee.

11. Ministry of Corporate Affairs, Notification dated 20-9-2017.

12. Companies Act, 1956, S. 372-A.

13. Although the term used under S. 186(1) of the Act is “acquire”, it would be rather counter-intuitive to the objective of the legislature to not incorporate setting up of a new subsidiary within the meaning of the said term.

14. Banking Regulation Act, 1949.

15. Reserve Bank of India Act, 1934, S. 45(I)(f).

17. Insurance Regulatory and Development Authority Act, 1999.

18. Companies Act, 2013, S. 2(45).